Taxation is an essential aspect of working remotely as a digital nomad. Mastering taxation as a Digital Nomad can get quite complicated, especially when working for a company abroad while traveling. This blog post aims to guide you through the process of understanding your tax obligations, available solutions, and the pros and cons of each option. Additionally, we will explore the concept of becoming a “tax nomad” – is it possible not to have a tax residency anywhere?

Solution 1: Establish Tax Residency in a Low or Zero-Tax Country

One solution to the issue of taxation as a digital nomad is to establish their tax residency in a country that offers low or zero tax rates on income earned outside of their territory. This option requires proper planning and research to find a suitable country that recognizes remote work income as non-taxable.

Advantages:

- Lower tax rates or complete tax exemption on foreign-sourced income.

- Becoming tax-compliant without paying hefty taxes.

Risks:

- Each country has its rules for establishing residency, so ensure you meet the requirements.

- Governments may change their tax laws, putting your strategy at risk.

Solution 2: Double Taxation Agreements (DTAs)

Another way to deal with taxation as a digital nomad is to use DTAs are agreements between two countries to prevent double taxation on the same income. As a digital nomad, you can potentially take advantage of these agreements when you have a tax residency in one country while working for a company abroad.

Advantages:

- Avoidance of double taxation on the same income.

- DTAs may also protect you against taxation in a country where you are not a resident.

Risks:

- DTAs usually involve a great deal of paperwork and bureaucracy.

- Not all countries have DTAs, limiting the number of locations where you can work without issues.

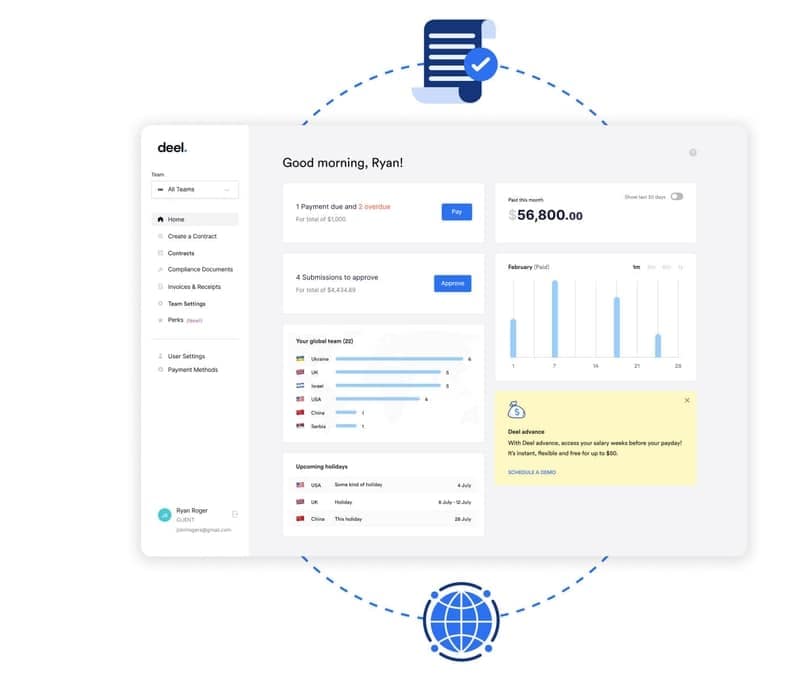

Solution 3: Using Employer of Record (EoR) Services

Using Employer of Record (EoR) Services is another option for taxation as a digital nomad. An EoR is a service that legally employs a remote worker, handling all employment and tax obligations on behalf of the worker and their actual client or company. EoRs are particularly useful for digital nomads who work for clients in multiple countries.

Advantages:

- EoRs handle cross-border tax compliance for you.

- Simplification of payroll and employment aspects, giving you more time to focus on your work.

Risks:

- EoR services can be expensive, often charging a percentage of your salary.

- Some EoRs have limitations regarding the countries they operate in or the services they provide.

Solution 4: Utilizing Digital Nomad Visas

Digital nomad visas, also known as remote work visas, are becoming more popular worldwide. These visas allow remote workers to reside in a country legally and work for an overseas company while adhering to local tax regulations.

Advantages:

- Simplifies the visa process and facilitates legal residency in a foreign country, compared to a tourist visa.

- States clearly your work status in the local jurisdiction, providing better compliance with tax laws.

Risks:

- Limited availability, as not all countries offer digital nomad visas.

- Visa requirements may vary between countries, and some may require a minimum income or financial proof.

Solution 5: Providing Services as a Contractor

Setting up Your Own Company and Providing Services as a Contractor can be an effective way to deal with the issue of taxation as a digital nomad. Establishing your own company or offering your services as an independent contractor may provide better tax efficiency and control over your financial situation. Depending on the company’s location and structure, you can use this setup to optimize tax planning while being compliant with local regulations.

Advantages:

- Gain more control over your tax situation by setting up the company in a jurisdiction with favorable tax laws.

- Potential access to better legal protection and a more straightforward invoicing process for clients.

Risks:

- Additional administrative tasks, including managing your company’s financials, tax obligations, and potential audit risks.

- Some countries may not view independent contracting favorably, complicating tax compliance.

Is it possible to be a “Tax Nomad”?

A completely different approach to taxation as a digital nomad is to become a “tax nomad” however achieving the status of a “tax nomad” – not having a tax residency anywhere – is a complicated and potentially risky approach. Countries have strict laws about taxation, and not complying with them might result in significant legal and financial consequences. Some digital nomads try to spend less than the required taxable residency period in each country to avoid establishing a tax residency. However, this method demands proper coordination and careful planning that might not work for everyone.

We have written about this more in the post The Tax Nomad Lifestyle: Risks & Opportunities.

Conclusion

When it comes to taxation as a digital nomad, researching your options and staying informed is crucial. From establishing tax residency in low-tax countries to leveraging digital nomad visas and setting up your own company, each solution brings its advantages and risks. It is essential to consult with a tax professional to ensure you remain compliant with tax regulations worldwide and avoid any legal issues down the line.

- Quiz – was this article helpful? Please take a moment to answer 5 quick Questions.

- Ask A Question – confused about taxes? Join our Facebook Community & Ask A Question.

- Feedback – we are only humans, so if you see anything missing/incorrect, please let us know.

Want to work remotely from abroad?

Check out one of the Digital Nomad Visas.

Last updated November 18, 2023.

REVIEW

FAVOURITES

SHARE

NEWSLETTER

No Spam, Just Updates!

FOLLOW US

DIGITAL NOMAD VISAS